REVISITING YOUR RISK TOLERANCE

I have been reading in my investor newsletters as well as several other authoritative sources that the markets, especially the US stock market are, at present, extremely overvalued. Some of these sources presented data that, they believe, clearly indicate we are in the final stages of a “market melt up,” similar to the the tech bubble in 1999. As such, they all believe that a major market meltdown is on the horizon.

As expected, these sources are a little vague on the timing of the coming meltdown as no one can accurately predict the start of a bear market. However, based on all data they provided and some of the comments made, my guess is the editors/analysts are thinking we may experience a major market drop within the next 12 months.

So I thought I would use this blog post as a reminder to everyone to be sure that your financial portfolios are in line with your own personal risk tolerance. We have experienced years of increasing stocks prices, so, at a minimum, I would recommend revisiting your “target” equity allocation percentage and, if necessary, “re-balance” your portfolio back to your chosen target.

For those who may not be sure what their personal level of stock market risk tolerance is, I will provide a couple ways to do this that I wrote about in my book, “Charting an Early Retirement.”

The first way is to just use an old simple formula that many people consider outdated. People think this, not because the formula is old, but because they believe it is too conservative for today’s market conditions. However, being a very conservative investor myself, I do not think this.

The formula is: Your portfolio Equity Allocation % = 100 Minus Your Age.

Using this formula a 30 year old investor would have as a target a portfolio of 70% in stocks and the rest in fixed income or alternative investments. A 70 year old investor would only have 30% of his portfolio in stocks.

Many financial advisors today believe the above formula is out-dated due to today’s environment of very low interest rates. They believe investors should have a much higher allocation to stocks. These advisors are not wrong about the new investing environment we are in. It is difficult to hold a lot of fixed income investments today that yield next to nothing.

But the reason I still like this formula is because, regardless of the new investing environment, investor behavior has not changed. My opinion is that, if we experience significantly more market volatility in the months and years ahead, this “old fashioned” conservative formula will serve most investors even better than in generations past. Why do I think this? Because much of investing is about discipline and not selling at the first sign of trouble. Because of this lack of discipline, I think if we have another market crash like the 50% we saw in 2008-2009 or even the short-lived 35% drop we saw last year in 2020, most investors will do even more panic selling than they otherwise would. I believe this because, with an even higher allocation to stocks than what the “old-fashioned” formula calls for, the fear investors will experience seeing an even bigger portion of their portfolios evaporate will be too much to resist and they will bailout of the markets at the wrong time (right near the bottom) as most retail investors do. And history shows that, after being burned by a serious market meltdown, most investors need a couple years to get their courage back to invest in stocks again, missing out on much of the market recovery phase. This fear cycle is one of the big reasons why the average investor under-performs the market.

Earlier I mentioned a couple ways to determine your appropriate equity allocation. The above formula is really just a general guideline best for beginning investors who are not experienced enough to evaluate their personal risk tolerance. For most investors, I recommend using a second method for determining their risk tolerance. This second method is simply a logical step-by-step approach using recent market history as a reference to assess your risk tolerance level.

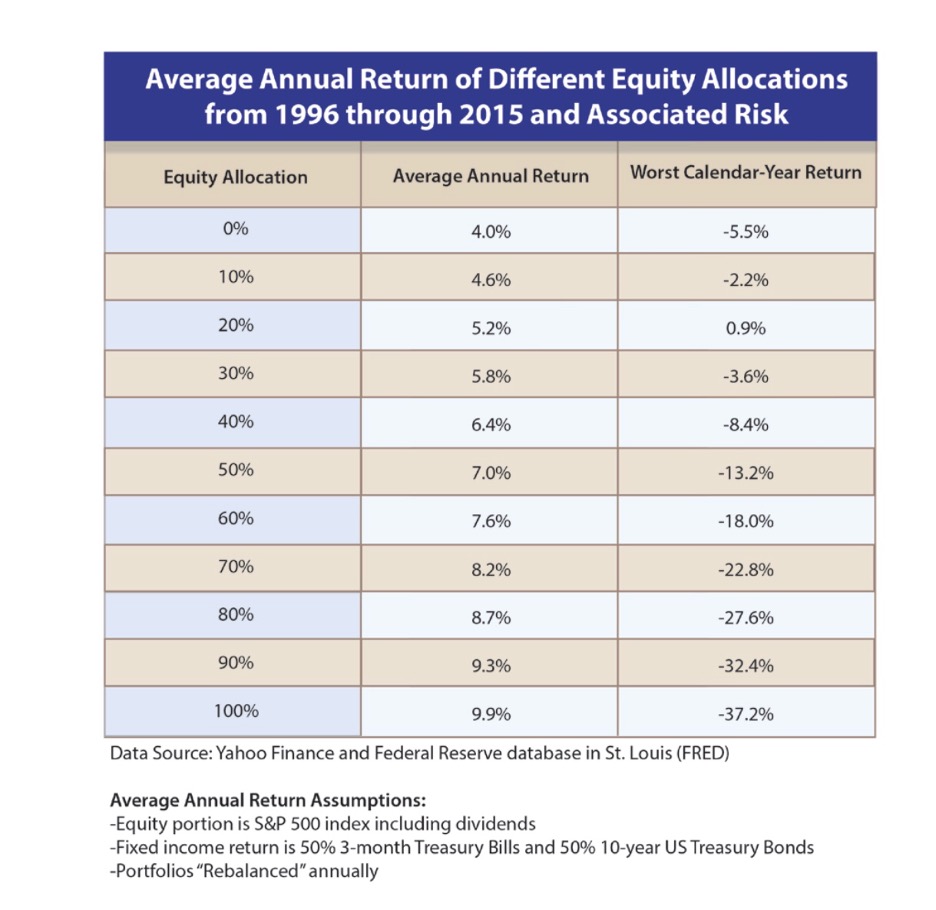

An example of recent market history is the data I used to compile the table below. The first column lists the different equity allocations from 0% to 100% in 10% increments. The second column lists the average annual return for the associated equity allocations for the 20-year period from 1996 through 2015. The third column shows the corresponding “Worst Calendar-Year Return” that the investor’s portfolio would have had to endure in order to obtain the average annual return listed for each equity allocation during that 20-year period.

The second method is just a simple self-assessment exercise. Look at the right-hand column in the table below showing the “Worst Calendar-Year Returns.” Let us assume later this year we experience a big drop in the stock market. Let’s say the drop is similar to what we experienced in 2008 resulting in the S&P 500 Index dropping 37.2% for the year. Now ask yourself, if you had an 80% equity allocation, would you be comfortable with a 27.6% loss to your portfolio? That would mean a $1 million portfolio is reduced to $724k in a matter of a few months. Yes, the market has bounced right back the last couple times this has happened,…..but what if it doesn’t this time? This time your portfolio stays at $724k for a couple years! If this size drop makes you uneasy, then an 80% equity allocation is outside of your comfort zone.

Next assume you have a 70% equity allocation when the market bust occurs. Ask yourself how you would react to a 22.8% reduction to your portfolio over a few months? Your $1 million portfolio drops to $772k,….and stays there for a couple years. If you are still not comfortable, then a 70% equity allocation is also too high for you. Go through each equity allocation and make this same assessment. When you find the biggest drop you believe you could tolerate without doing any panic-selling, this is likely the right equity allocation for you at this time.

Should anything else drive your target equity allocation? Risk tolerance is the big determinant, but there are other things that can shape your risk tolerance. For example, if your portfolio is so big you can easily live off the dividend income it generates, then you can certainly have a higher equity allocation because a big drop in the stock market does not affect your income. Another consideration is if you have a generous employer pension. If your pension combined with social security benefits provides enough annuity-type income that it comfortably covers all your annual living expenses, then you can definitely have a higher equity allocation. Again, this is because you are less likely to panic if the stock market experiences a big drop.

To wrap up this post, despite what many retail investors think about themselves, they are terrible at timing when to get into and out of the markets. Therefore they should not even try to do any market timing. For most retail investors it is best to determine the equity allocation that best fits your risk tolerance. And after making this determination, stick with it through any market volatility you encounter, only making changes by periodically re-balancing your portfolio back to your chosen equity allocation when needed.

Did you enjoy this post? Why not leave a comment below and continue the conversation, or subscribe to my feed and get articles like this delivered automatically to your feed reader.

Comments

No comments yet.

Sorry, the comment form is closed at this time.