Over-valued Stock Market, What Should an Investor Do?

Today’s investment markets are extremely difficult. Safe fixed-income assets pay near zero interest and the stock market is at an historically high valuation. So what is a conservative investor to do, especially someone who is retired or is nearing retirement?

I kept a lot of funds out of the stock market last year as I found the market to be very puzzling. I could not understand why the equity markets kept moving higher every week, yet at one point last year, over 40 million people were out of work. As it turned out, I really under-estimated the impact of the Federal Reserve and being mostly out of the market was the wrong thing to do. In the last 12 months, with the pandemic winding down, the employment situation and company earnings have gotten much better. But, with the increase in the stock market over the past year, equity valuations are still near all-time highs. So I am still hesitant to add more to the market.

Furthermore, there are all sorts of market analyses, based on historical data, pointing to a very disappointing decade ahead for stock returns. Below is one such analysis written by Mark Hulbert for the MarketWatch web site about 6 months ago. I could have picked out a dozen others drawing similar conclusions.

The stock market’s expected return from now to 2030 – MarketWatch

If you do not feel like reading the MarketWatch article above, below is a quote from the article making the author’s salient point:

“The stock market’s prospects over the next decade are dismal. It would go against an overwhelming body of historical evidence if the stock market over the next decade were to perform at anywhere close to its long-term average.”

With current market valuations being near all-time highs, it feels to me like a big market crash could happen at any time. The conclusions of articles like the one above would seem to indicate that maybe the best thing to do is to keep all your money in cash. We certainly do have a lot of money in cash and cash-like instruments, but with inflation to starting to rear its ugly head, I just do not think going to all cash is the smart thing to do. Portfolio growth is important for this reason and stocks can provide this growth.

I don’t know about others, but I am not going to buy Tesla stock with a current P/E ratio of about 635. To be honest, I do not even feel comfortable buying Google with a P/E ratio of 35. So, again, I ask, what is an older and more conservative investor to do? Below I will discuss what I have decided to do.

Everyone’s level of risk tolerance and financial goals are different, so this may not be the right solution for others, but this is the best solution I can come up with in today’s environment that might solve our growth problem without taking too much risk. It is an approach that goes back to investing basics: Investing in Dividend Growth Stocks. There is nothing new about this approach, it is really a form of “Value-investing.” But it seems that most people have lost interest in this approach as the last decade has heavily favored non-dividend paying high growth stocks. Another reason I have chosen this approach is that it provides increasing income that can potentially keep up with inflation, which is important for investors at or near retirement.

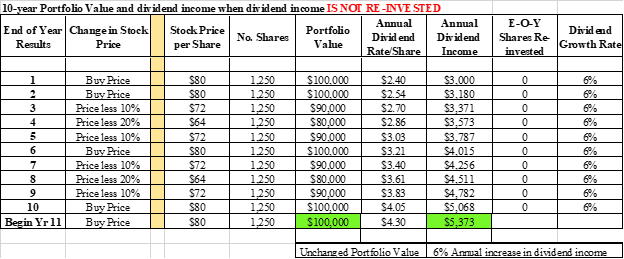

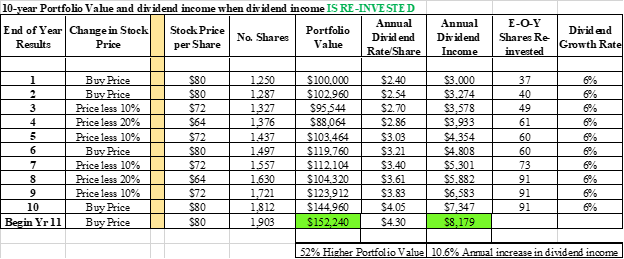

So, my specific approach is to invest in high-quality dividend stocks that grow their dividend every year at a healthy clip. The reason I like this approach is that, even if the stock price does not increase over the next decade, the income should still grow every year, if for no other reason than because of inflation. And, of course, if a stock’s income keeps increasing every year, usually the stock price will follow. The two charts below provide a couple of examples of the increase in annual income over a 10 year period provided by a dividend growth stock. In each example I have assumed a $100,000 stock portfolio represented by purchasing 1,250 shares of a high-quality dividend growth stock (like JNJ, HD, or PEP, but at better valuations) for $80 per share. I assume that this fictitious stock currently yields 3% or $3,000 in year one.

Consistent with the expected returns of 0% per year in the article above, in both examples I have assumed the stock price ends the 10 year period the same price as it began (in this case $80 per share). I also assumed in each example that the stock price drops by 20% twice over the 10-year period. The final and most important assumption is that the annual dividend payment increases by 6% every year.

The only difference between the two charts is Chart A assumes that the investor spends the dividend income every year. Chart B assumes the investor “re-invests” their annual dividends every year in more company shares.

Chart A

Chart B

In Chart A, because the $80 share price is the same at the end of the 10 year period as at the beginning, the portfolio value is unchanged at $100,000. (NOTE: It is unlikely that the stock price will not increase in nominal terms due to inflation. So, this example is really about purchasing power after 10 years). However, the 6% annual dividend growth does increase the annual income available for spending in year 11 by 79% (from $3,000 to $5,373). This is a big increase in annual income. So, I think this is a good strategy if you are looking for current income that keeps up with rising costs.

However, if you are able to refrain from spending the current dividend income and re-invest these funds in more shares every year, you can increase your portfolio value, but, more importantly, you can really increase your income after 10 years. The final portfolio value in Chart B is 52% larger than in Chart A. This happens because re-investing the dividends in more shares increases the share count even though the ending share price of $80 is the same as the beginning share price.

However, the big difference in the two examples is the much higher income available after 10 years of re-investing the dividends in more shares. By doing this, the annual income starting in year 11 is 173% greater (from $3,000 to $8,179). This represents a 10.5% increase on an annual basis. I think that is very impressive and is accomplished with much lower risk than many other investing approaches.

What if you could find a group of stocks that, on average, grow their dividends at an 8% rate per year. When you re-invest those dividends as in Chart B above, you get a portfolio value after 10 years of about $155,000 with annual income of $9,173…..a 206% increase. Every little bit helps.

For those of you who are paying close attention, you will notice that in Chart B, re-investing your dividend income in more shares each year to increase your future income actually benefits from the share price not increasing every year. In fact, purchasing more shares every year while the price is flat and at the same time the dividend is growing, will turbo-charge your income over the decade. So, think about that! If more income is your goal, then you should hope that all the experts’ predictions are correct…..that stock prices increase very little over the next decade. I think this is a very good low risk investment approach to increasing your retirement income.

Of course, this strategy assumes that the dividend growth stocks you select will consistently grow their dividends every year. But I believe you can find 12 to 15 stocks that, on average, will do this. Check the companies on the annual lists of “Dividend Kings” and “Dividend Aristocrats” which have increased their dividend payments for 50 and 25 years respectively.

After going through this exercise, one has to wonder if living on your current stock income is the right approach. Currently, our fixed-income assets are only returning 3.5% on average annually. That ends in about 6 years. I am also of the opinion that the Federal Reserve is never going to allow interest rates to increase above where they are today, at least not in my lifetime. Why? Because the US government debt is so high now that any increase in interest rates will make the US government’s debt unserviceable.

Therefore, if this dividend growth stock approach is returning between 6% and, if you re-invest your dividends, 10% annually. Maybe it makes better sense to spend some of the bond principle rather than the annual stock dividend payments. This way one could re-invest the stock dividends and create even greater income down the road. This is what we started doing in 2018. This is not a recommendation to anyone else, just something to think about.

Finally, since stock valuations are so high right now, I certainly do not want to just dive in and buy these stocks all at once. I think I will invest a little bit on the best names available every month over the next couple years, kind of like “dollar-cost-averaging.” Like I said earlier….back to the investing basics.

Did you enjoy this post? Why not leave a comment below and continue the conversation, or subscribe to my feed and get articles like this delivered automatically to your feed reader.

Comments

No comments yet.

Sorry, the comment form is closed at this time.