Important Investment Concepts, Part III

This blog post is the third and final installment about what I feel are the most important investment concepts that all stock investors should be aware of. Today’s important investment concept is, when investing in stocks, always pay attention to valuations. This post will discuss the importance of knowing market valuations on a broader level and how valuations impact long term portfolio returns.

The data I will present is based on the common corporate financial measure, the Price/Earnings (P/E) ratio. The P/E ratio represents the share price one pays for a dollar of corporate earnings. The long term historical average P/E ratio for all US stocks is about 15 to 16. Some industries typically have lower than market average P/E ratios and other have higher than average P/E ratios. The P/E ratio is usually tied to expectations of earnings growth. For example, the utility sector is a slow growth industry so utility stocks typically have P/E ratios of 12 to 14. Conversely, high growth technology stocks often have higher P/E ratios around 18 to 20. But broad stock market indexes such as the S&P 500 index usually average around 15 to 16.

It is important to pay attention to the P/E ratios for the fund indexes you invest in as they affect your long term returns. Yale University’s Economics Professor Robert Shiller gained fame when, in 1999, he predicted the 2000 stock market crash and in 2007 predicted the 2008 market crash. Professor Shiller bases his predictions on current market valuations as determined by the market’s previous 10-year average P/E ratios. He periodically publishes his “expected 10-year forward real returns” for stocks based on the current 10-year average P/E ratios. Professor Shiller has a unique way of deriving his P/E ratio, but the nuances of how the P/E ratio is calculated is not important. What is important is the overall assessment of whether the stock market is overvalued or undervalued.

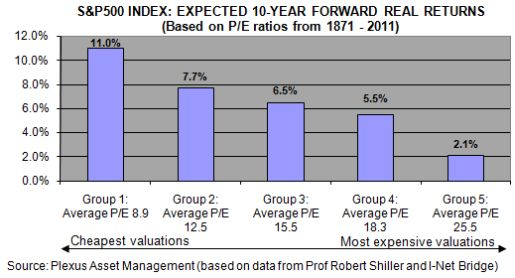

Below I have reproduced a table based on data provided by Professor Shiller. The table shows the average annual 10-year real return of the S&P 500 index from 1871 to 2011 by the P/E ratio. The P/E ratio (the horizontal axis) is broken into 5 groups from cheapest valuation to the most expensive valuation with the purple bar showing the corresponding average real return for that group. The table shows an obvious pattern. At any particular point in time the average P/E ratio for the S&P 500 index affects the expected 10-year real return of the index. That is, the lower the current P/E ratio the higher the expected market return will be over the next 10 years and vice versa.

The table indicates that the worst time to invest in stocks is when market P/E ratios are above 20. The S&P 500 index P/E ratio was above 30 in 2000 during the technology bubble. The following 10-year S&P 500 index average annual return from 2000 to 2009 was 1.2%. The real return for this period was even lower. Obviously it is best to invest in stocks when P/E ratios are below 10. However, single digit market P/E ratios do not occur very often. In the US we have not seen market wide P/E ratios below 10 since the early 1980s. But it is not practical to stay out of the stock market until we have single digit P/E ratios. If you are a long term investor, you need to be in the market all the time. However you should keep market valuations in mind when investing in stocks.

How should you incorporate this data in your investing practices? They are several ways to allow for P/E ratios in your investing. My portfolio is large enough that I do invest in individual stocks (only large blue chip stocks). I occasionally buy or sell individual stocks based on their P/E ratio, but only when the ratio becomes extreme one way or the other.

Generally I only make broad changes to my portfolio. How I take the market P/E ratio into account when making broad portfolio changes is I make small adjustments to my target equity allocation. For example, when the market P/E ratio is above average such as in 1999-2000, I would (temporarily) lower my target equity allocation 5% or 10%. Conversely, when the market P/E ratio was below average, I would add 5% or 10% to my target equity allocation.

In reality you need some awareness of valuations to practice the two previously discussed investment concepts on “avoiding the large losses” and “doing the opposite of what everyone else does.” So when reviewing market (or sector) valuations, to consider whether you should make an adjustment to your equity allocation, keep in mind how the valuations might impact the other two important investment concepts.

Did you enjoy this post? Why not leave a comment below and continue the conversation, or subscribe to my feed and get articles like this delivered automatically to your feed reader.

Comments

No comments yet.

Sorry, the comment form is closed at this time.