Post #2 – “LBYM” – The First Rule of Personal Finance

The financial advisory guru, Dave Ramsey, www.daveramsey.com, once wrote that wealth accumulation is 90% behavior and 10% knowledge, and I could not agree with him more. The ability to retire someday is mostly about a person practicing good financial behavior, week after week, year after year… The more education you acquire about personal finance and investment planning, the better your results will be. But the most basic fundamental principles of personal financial management must be employed to accumulate the nest egg required for retirement.

A good analogy is a football team preparing for a game. The coaches will develop a game plan and even draw up some special plays for the offense to use to beat the other team (the 10% knowledge). But all the game planning and the customized plays will not help the team without being able to perform the basics of the game; that is, blocking and tackling (the 90% behavior). And so it is with retirement planning. All the retirement planning and strategizing in the world will not help without practicing good financial behavior.

The First Rule of Personal Finance

There are many personal finance principles that are important to know; but the first rule of personal finance is LBYM. LBYM is an acronym that often appears on the discussion forums of many retirement planning and related web sites. It stands for “Living Below Your Means.” This rule is simple and obvious; but it is not practiced very much in America today. In fact, the average American appears to be living far above their means.

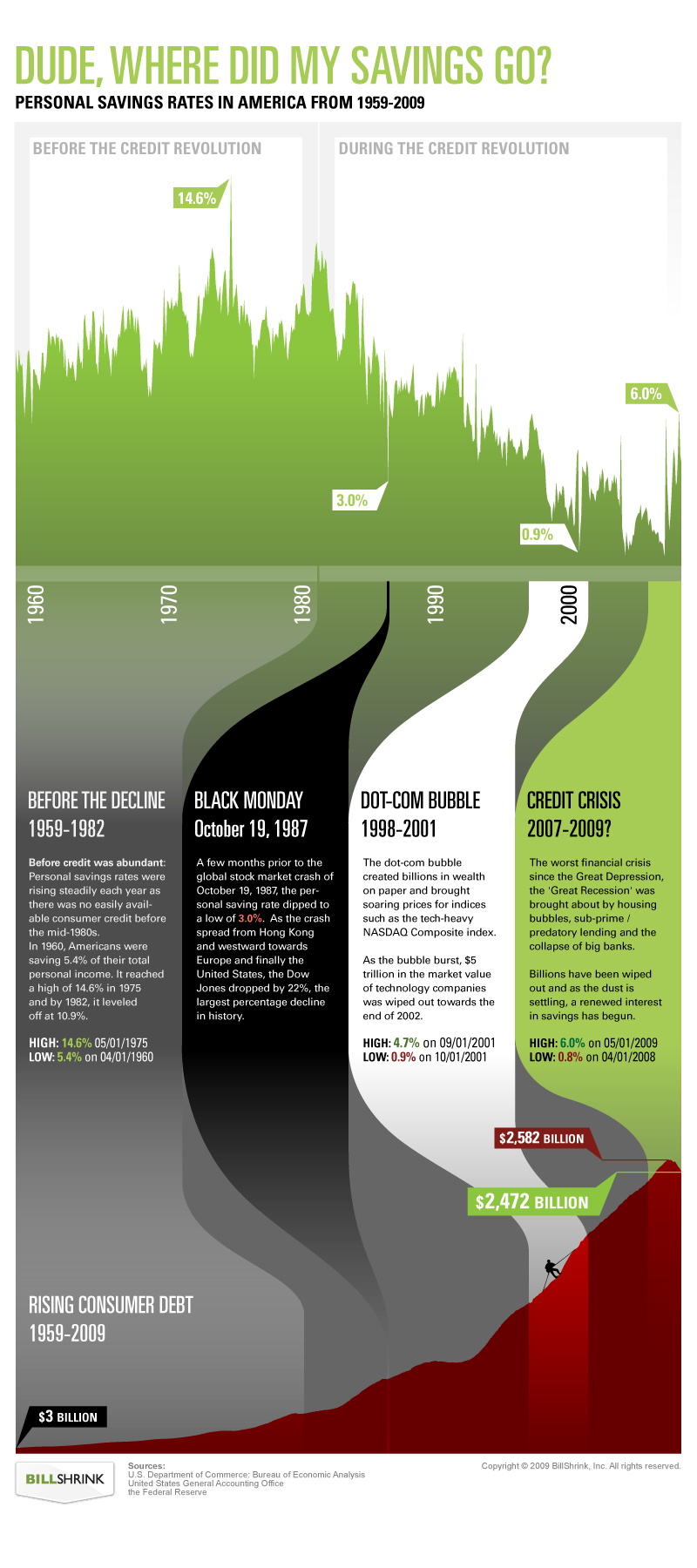

The included graph shows the personal savings rate in America. The graph clearly illustrates America’s declining savings rate and its’ rapid rise of consumer debt in the last 30 years. Given the kind of numbers in the graph, it appears that the average American is ignoring the first rule of personal finance of LBYM. I know some people experience bad circumstances like divorce, huge medical bills, and job loss and must borrow money for life’s basic needs, but these people are exceptions. The amount of total consumer debt in America today can only mean that a large majority of people in America have the ability to live below their means but choose not to do so.

A Corollary to the First Rule of Personal Finance

This leads to another principle of personal finance that needs to be understood by everyone planning to retire someday without the benefit of some kind of windfall. I refer to this principle as a corollary to the first rule of personal finance; “If you live above your means today, you will be required to live below your means tomorrow.” I have many acquaintances currently experiencing this corollary. In fact, from the consumer debt graph, it is clear that this principle is being played out among a large swath of America today. Many baby boomers, beginning in their 30s, began living the good life. They bought luxury cars, purchased large houses, bought every new electronic gadget available, took fancy vacations, etc. In short they were not living below their means during their 30s and 40s. Now, in their 50s and 60s, these same people realize that time is running out on them and they have made a major shift in their spending levels. You can see this in the consumer debt graph. The last couple years the savings rate has increased significantly and the amount of total consumer debt has ticked down slightly. It seems it took the recent financial crisis for many people to come to the realization of LBYM. These people are now living below their means as they play catch up on their retirement assets. Some people’s retirement assets, undoubtedly, took a big hit in the 2008-2009 financial crisis (something I avoided and will write about later in a future blog). But most baby boomers were far behind the retirement 8-ball even before the recent financial crisis. Review the data in this Employee Benefits Research Institute Survey conducted before the financial crisis. The data shows, in April 2007, that 62% of Americans age 55 and older had less than $150,000 in retirement savings. These people now must live far below their means if they have any hope of retiring at all.

Recently I had a conversation with a 33-year old friend which illustrates this principle and the choices that must be made. My friend indicated, because of child care costs, she was having trouble saving money in her company retirement plan. My friend also happens to drive a late model Lexus. I suggested to her that perhaps she should consider selling her Lexus and buy a less expensive car like a Geo Metro to allow for her to save more. She said she really did not want to do this (she gave some lame excuse that I don’t remember). I said to her, “Betty, you are going to drive a Geo Metro at some point in your life. The only question is will it be when you are 33-years old or 53-years old.” I don’t know if she got the point.

Once you dedicate yourself to the LBYM rule and are saving money at a healthy clip, other investing/planning can be done. After all, if you have nothing saved, there is nothing to invest or plan for.

Did you enjoy this post? Why not leave a comment below and continue the conversation, or subscribe to my feed and get articles like this delivered automatically to your feed reader.

Comments

“If you live above your means today, you will be required to live below your means tomorrow.”

This is not absolutely true. The credit revolution marked more than anything a decrease in the cost of borrowing. Overlooked in these types of debate is the fact that in recent times both the “value” of investing and the “cost” of borrowing have converged and in some cases almost flipped. Taking just the very basic example of a straight savings account with 1.5% interest coupled with an expectation of inflation at 3% shows that “saving” has a negative return of 1.5%/year. On the flip side borrowing money at 4.5% is not unreasonable for many people and coupled with an inflation rate of 3% and a mortgage tax break of about 33% of the interest and there is virtually no cost associated with borrowing. If you take this further and add in some value to rising wages (a fantasy) then there may even be positive returns to borrowing because you will be paying back the loan in relatively smaller portions of your paycheck.

Homo Economicus should be making decisions that maximize their lifetime consumption. Your article seems to imply that the lack of savings is some sort of moral failing of the “ME” generation when it looks a lot like rational responses to the current economic circumstances.

Sorry, the comment form is closed at this time.

Great advice!